Многолетний опыт

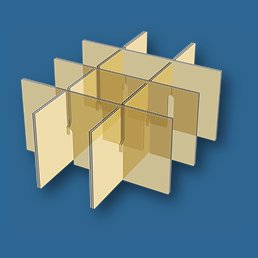

Мы можем предложить гофропродукцию любого типа, в том числе гофрокороба любой возможной, необходимой Вам, конструкции из различного гофрокартона (3-х, 5-ти, 7-ми слойных). Имеется возможность наложения высококачественной печати любой сложности. Для каждого изделия подбирается оптимальная его конструкция и необходимый гофрокартон. Мы поставляем упаковку для самых разнообразных отраслей промышленности. Накопленный опыт позволяет нам помочь каждому клиенту подобрать оптимальный вариант необходимой ему упаковки.

Поставляемое сырье – от надежных производителей

Наша компания является официальным представителем крупнейших европейских производителей гофропродукции в Прибалтике (Литве, Латвии, Эстонии), поэтому мы можем обеспечить высочайшее качество поставляемой нами продукции.

Индивидуальный подход к каждому клиенту

Нашими клиентами являются как довольно крупные, так и компании среднего бизнеса самых разнообразных отраслей промышленности из Литвы, Латвии, Эстонии, Швеции. Условия поставок оговариваются индивидуально с каждым клиентом. Наш многолетний опыт позволяет правильно расставить все акценты для успешного сотрудничества. Основными критериями успеха считаем цену, качество и сроки нашей поставляемой продукции, а также гибкую систему оплаты.

Картонная упаковка - оптимальная для птицы, мяса и иных изделий.

В настоящий момент на рынок упаковочной («тарной») индустрии в большинстве поставляется продукция из двух видов сырья: пластмассы и гофрокартона, и последний является наиболее популярным. Выбор потребителя в пользу упаковки из гофрокартона, на наш взгляд, самый оптимальный. И это в силу нескольких важных причин: гофролотки дешевле пластмассовых; если сравнивать их по цене, то гофротара обойдется в разы дешевле. Сравните сами и убедитесь в этом. Другая причина в том, что картон – экологически чистый и безопасный материал с возможностью его вторичной переработки. Если вы заботитесь о сохранности окружающей среды, гофролотки - идеальная упаковка для вас!

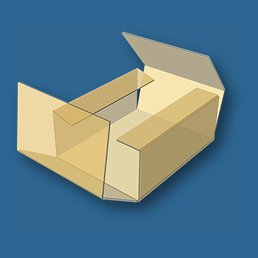

Кроме того, гофрокартон обладает легкостью, пластичностью, к тому же – достаточной прочностью, т.е. свойствами, делающими его незаменимым для упаковки самых различных товаров. Все эти особенности сказываются на легкости и малогабаритности гофротары. В сравнении с лотками из пластмассы, гофролотки – несравненно легче! Поставляются они в разобранном («плоском») виде, что позволяет сэкономить немалые средства на их логистике.

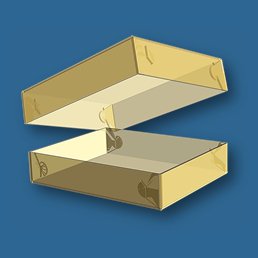

По остальным параметрам картонная коробка ничем не проигрывает пластиковой таре. Плюс к этому имеется возможность изготовление различных ее конструкций – с усиленными стенками и ребрами жесткости и т.п., что увеличивает прочность картона в несколько раз, а, например, верхняя крышка защитит продукцию и позволяет без труда штабелировать их на складах.

Ее удобно переносить вручную. В конструкции могут быть предусмотрены вырубные ручки, а сам размер тары достаточно удобен для ручной транспортировки. К тому же упаковка из гофрокартона отлично выдерживает достаточно большие перепады температур.

В соответствии с изложенными в Директиве Европарламента и Совета Европы № 94/62/EС положениях в отношении упаковки и утилизации упаковочных материалов, а также в Законе Литовской Республики «О порядке использования поставляемой на внутренний рынок Литовской Республики упаковки, а также ее остатков» требованиями, настоящим подтверждаем соответствие поставляемой нами упаковки упомянутым правовым актам, а также стандартам LST EN 13432:2004, LST EN 13429:2007, LST EN 13430:2007; LST EN 13431:2007, LST 1655:2002, LST CEN/TR 13695-2:2004.

Другая продукция

Водонепроницаемая упаковка из PE-ламинированного, AQUA-крафт-лайнера, Парафинированного гофрированного и обычного (однослойного) картона.

Пластмассовые ручки – используются как вспомогательное средство в картонной упаковке продуктов питания, бытовой техники, сыпучих и др. продуктов.

Металлические заклепки – используются также и для фиксации пластиковых ручек на упаковке.

Весь каталог FEFCO: СКАЧАТЬ

Онлайн запрос

Напишите нам.

UAB Artepak

пр. Тайкос 94-315,51179, г. Каунас, ЛитваТел./факс: +370 37 454111Моб.телеф.: +370 646 79001

(LT/RUS/PL)

Этот адрес электронной почты защищён от спам-ботов. У вас должен быть включен JavaScript для просмотра.Моб.телеф.: +370 609 77797

(LT/ENG/RUS/PL)

Этот адрес электронной почты защищён от спам-ботов. У вас должен быть включен JavaScript для просмотра.Skype: artepakarunas